Real estate investors and developers should be poised for an upturn in industry trends as the post-pandemic disruption abates and positive cyclical forces gain strength.

The Federal Reserve is among the most important cyclical forces. Its pivot to reducing interest rates indicates a peak for inflation and construction costs — and the pivot is helping real estate markets to clear, boosting transaction activity. However, not all dealmakers are ready to jump in with both feet. After all, rate cuts also indicate a slower economy and that could affect net operating income (NOI) growth. The path to renewed vigor could take surprising detours.

The specific contours of what happens next won’t be exactly like what’s happened before. Today’s critical real estate investment factors are supply dynamics and a modernized stock of buildings. For example, newer office buildings offer amenities (the so-called “flight to wellness”) that make them preferable to the languishing stock of aging buildings. And in housing, there are too few developments catering to senior citizens whose ranks are growing by several thousand every day.

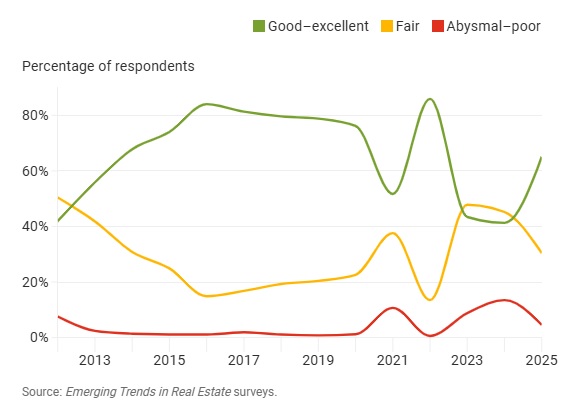

New real estate cycles are marked by a growing number of opportunities. In this Emerging Trends in Real Estate® report, we illustrate what’s improving and share the views of our survey respondents as they gauge real estate’s prospects for recovery and renewal.

Real estate firm profitability prospects for 2025